Back

BLIK Payment Method

What problem it solves or why you need it

BLIK is a popular payment method in Poland. It ensures convenient and safe online transactions. In addition, it speeds up the payment process removing the need to enter the card or recipient’s bank account number.

With BLIK payment available, you can attract more customers situated in Poland since BLIK is integrated with all the major mobile banking apps in Poland. It serves as an avenue for you to gain more user trust and elevate the transaction experience on your platform.

Moreover, your users can create a recurring payment system with BLIK. This automates the recurring payment of subscriptions, ensuring you receive the payments on time, always.

How it works

BLIK works with Polish mobile banking apps. Customers using BLIK for online payment will have to authenticate the transactions from their banking application using a 6-digit code.

The payment happens rather instantly once the user confirms through providing the code on the checkout page.

BLIK also has features where a customer can mark your platform as “remember”. Then they can pay on your platform without even needing to use the code, making the transaction process easier and faster.

How to set up and get started using it

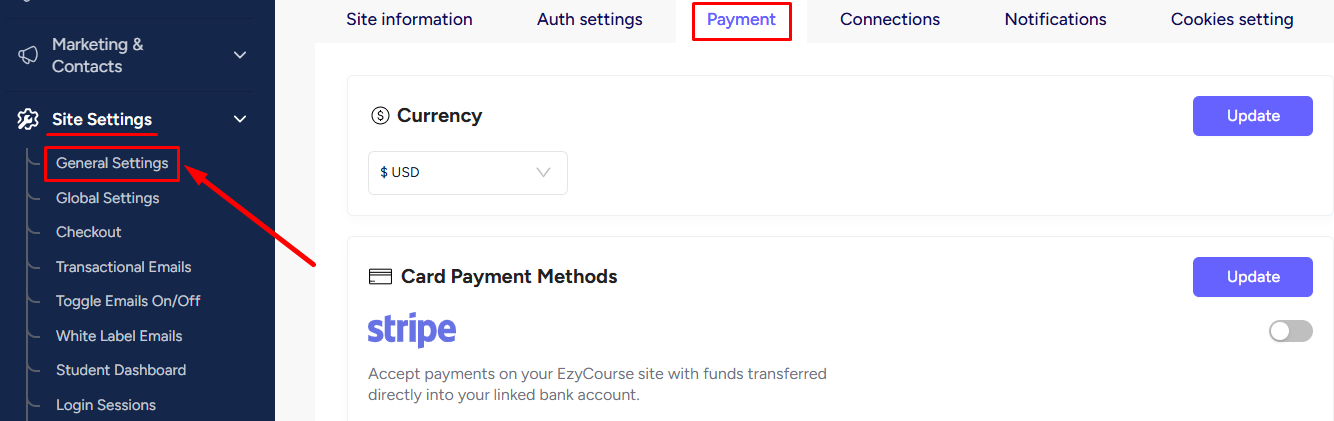

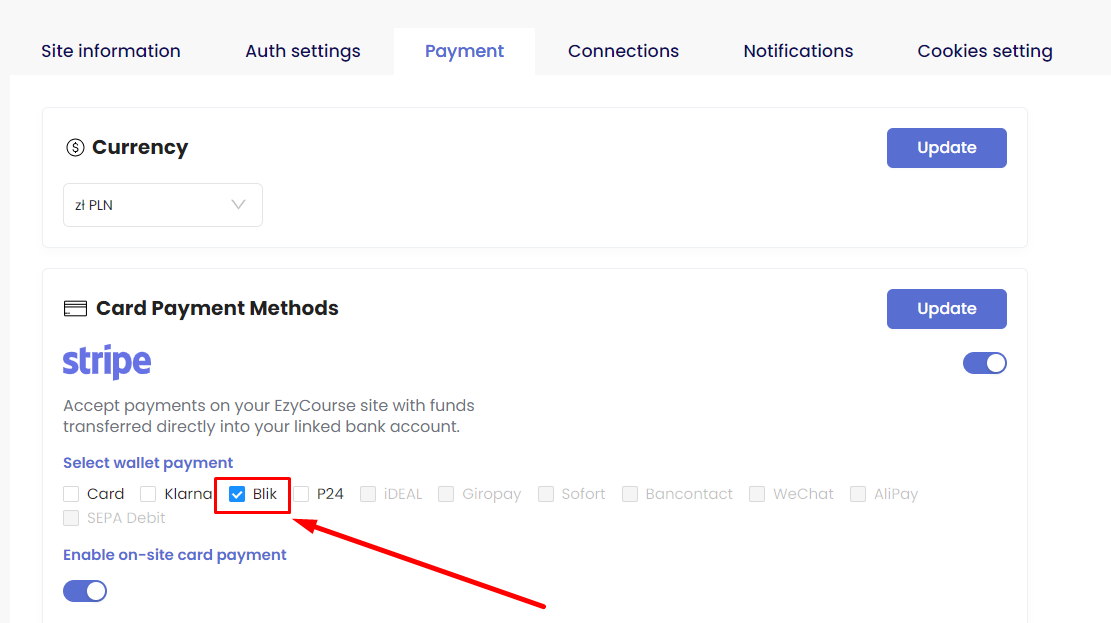

The hard part of integrating BLIK on the platform is up to us. All you have to do is choose whether you want to use it on your platform or not. And you can do that from Site Settings -> General Settings -> Payment tab.

From here, you can enable the BLIK payment method under Stripe and click the Update button. And that’s all you have to do to start receiving payments through BLIK.

[Note: Remember that BLIK is only available to use when your site’s currency is set to Polish currency (PLN).]

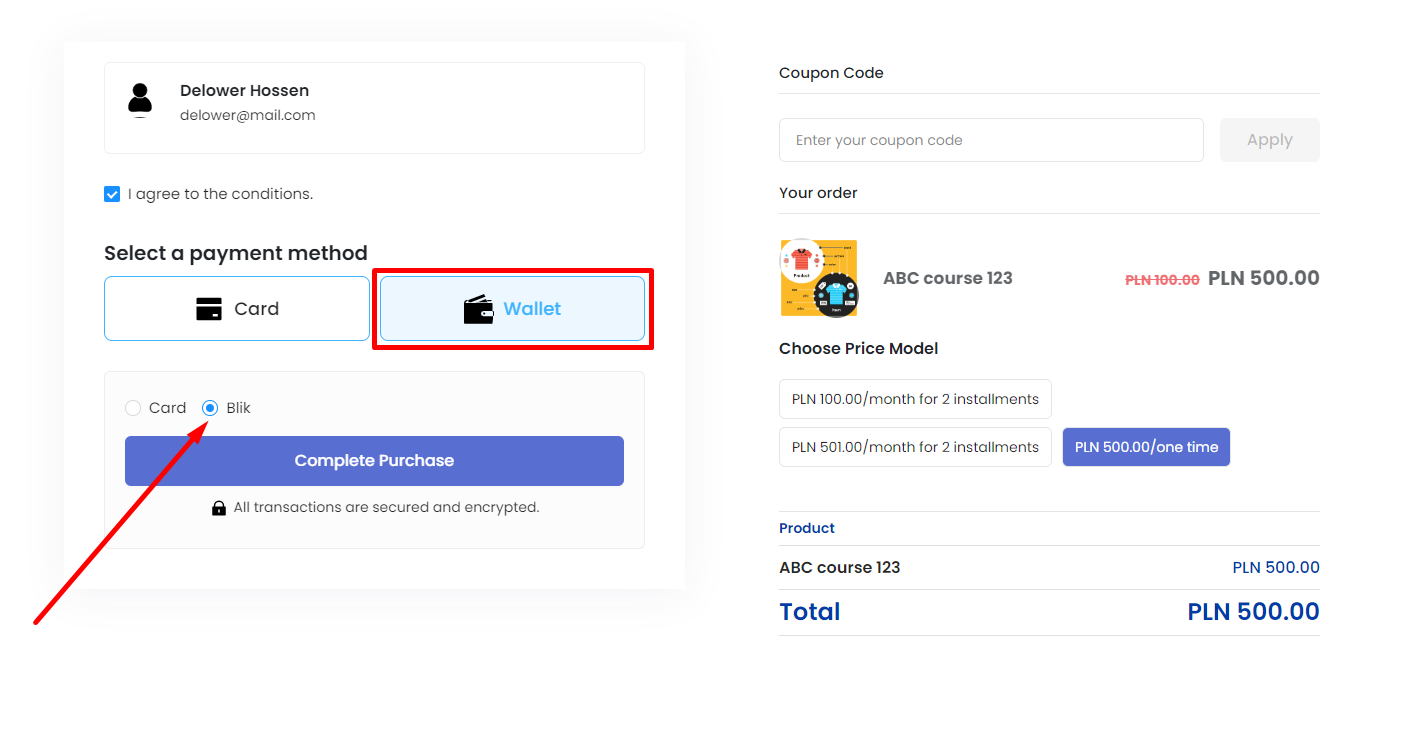

When enabled, your students will be able to use BLIK as a payment option on the checkout page of any product. They have to select Wallet and then choose BLIK.

When they try to purchase, they’ll be prompted to give the 6-digit code which they should receive on their mobile banking app from their banks.